Micro or industry analysis – 5 Forces and MORE forces

In this section, we will deal with one industry analysis technique called Porter’s 5 Forces. It should be stressed that there are various micro-environment analysis techniques and used in different contexts.

Porter’s Five Forces Framework is a tool for analysing the nature of competition in a market. He argues that these forces can be used to determine the attractiveness of an industry and the likelihood that organisations in an industry will be profitable.

Porter refers to the forces as the micro-environment, to contrast it with the more general term macro-environment (PESTLE).

These forces can affect the organisation’s ability to serve its customers and make a profit. A change in any of the forces normally requires a business unit to re-assess the marketplace. The table below summarises the outcomes of two analyses – noting the two extreme ends of the spectrum.

| Attractive industry | Unattractive industry |

| High profit potential | Lower profit potential |

| High barriers to entry | Low barriers to entry |

| Weak supplier bargaining power | Strong supplier bargaining power |

| Weak buyer bargaining power | Strong buyers buying power |

| Few players | Many players in the market |

| Few substitutes | Many substitute products or services |

The overall industry attractiveness is an indicative and not absolute measure of industry attractiveness or profitability as many other factors play a role.

Porter’s five forces include three forces from ‘horizontal’ competition–the threat of substitute products or services, the threat of established rivals, and the threat of new entrants–and two others from ‘vertical’ competition–the bargaining power of suppliers and the bargaining power of customers.

Understanding the market in which the organisation operates today is not as simple as asking the five questions Michael Porter asked in his five forces model. We should still ask these questions, but the dynamics in the market place and the structure (one can even say the architecture) of markets and role-players are much more complex.

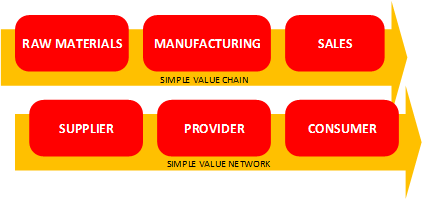

Industry structures are, however, much more complex and organisations need to contend with complex networks and business structures. Simple value chains or networks no longer exist, in a world of co-opetition, intermediation, disintermediation, and platform business models. A quick summary of some important considerations follows.

The simple idea that any industry is a simple linear value chain or network is a dangerous view of a market or market-place. Incidentally, markets were never that simple but choosing to use the simple view in the past was relatively OK because one could deal with complexities as they arise. Generally organisations had time to discover the dynamics within a market, but today that may be a risky bet.

The speed at which everything happens now necessitates that we understand market space dynamics a bit better before we make strategic choices.

Value is not delivered in a simple linear structured value network or value chain – and the reality is that it actually never was.

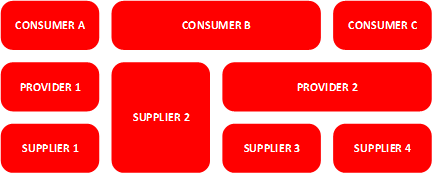

Today, it is easier to see the market and market players in an industry or industry segment as a stack of dynamic building blocks that can at any time be reconfigured to deliver a new value proposition.

It is also today much easier to become one of these building blocks, as barriers to entry into a market for some roles in the stack can be very low.

The number of blocks that depends on resources other than capital (which was the biggest traditional stumbling-block for new market entrants before) has reduced significantly. The key contributor is technologies that had a disruptive effect.

For one organisation to extend its reach in the stack, was traditionally only about forward-and-backwards integration as a strategic option. Now, however new opportunities exist to change the complete makeup of the stack, with strategies like intermediation, leveraged 3rd party assets and platform strategies (more on this later).

Previously it was also a strategic choice to focus on a smaller part of the network or on fewer customers by having a differentiation or focused differentiation strategy.

Now however, it is possible to have a micro-focus and to focus on a tiny, very specialised segment of the market and leveraging other components of the stack and still have a viable business.